4 Factors That Affect the Cost of Boat Insurance

April 11th, 2023 | 5 min read

Cruising the Seneca River or taking in a day of fishing on beautiful Lake Ontario are the daydreams of many soon-to-be boat owners. If you’re new to boating, you probably haven’t added insurance to that daydream.

But it’s important not to overlook the insurance for your boat or the costs associated with the policy. Knowing what impacts those costs is also critical to avoid overspending to protect a beloved pastime like boating. But have no fear, we’ll introduce you to the four biggest factors influencing boat insurance premiums.

As an agency in the middle of a river town, we’ve educated many boaters on balancing costs and coverage unique to the boating world so they can cruise without worry. We can do the same for you.

We understand that boat insurance is just one of many expenses to consider regarding boat ownership, and it’s important to find ways to manage costs wherever possible.

By the end of this article, you’ll learn what elements impact the price of boat insurance the most and how to use that knowledge to purchase the best policy for you.

With that, here are four factors that affect the cost of boat insurance.

Factor #1: Type of Boat

The type of boat you have affects the cost of boat insurance because different types of boats have different risks and costs associated with them. For instance, a sailboat is more likely to be damaged in a storm than a motorboat, so sailboats typically have higher insurance rates.

Similarly, a high-performance speedboat will be more expensive to insure than a pontoon due to the dangers associated with a faster-moving watercraft.

Some types of boats are more expensive to repair or replace than others, which also affects the cost of insurance.

Boats with carbon-fiber hulls are more expensive to repair than fiberglass boats. A boat with custom parts, a built-in GPS system, touchscreen bridge displays, and computerized hydrofoils is more expensive to repair than a boat lacking these features.

Knowing how a boat type will affect your insurance premium will reinforce your choice of vessel and its associated features.

Factor #2: Your Boat’s Value

Your boat’s value is closely tied to factor 2, boat type, but it relates to its specific characteristics, such as

- age

- motor, and

- length

Age

Concerning the age of your boat, the newer it is, the more expensive it will be to replace compared to the same model from 10 years ago.

Brand-new boats are like cars in that, for the first few years, the insurance company is responsible for insuring a higher value. Newer boats also face increased repair costs in the first few years due to the same high market value, so insurance companies charge higher premiums to compensate for those expenses.

Motor

Not all motors are created equally. Outboard motors are typically less expensive to replace than inboard motors. There are several reasons for this:

- Outboard motors are less complex and simpler in design, making them less expensive to manufacture.

- Outboard motors are also easier to access since they’re typically mounted on the transom of the boat, which allows for less expensive repairs and maintenance due to that easy access. Because the insurer pays for such services, a boat with an outboard motor can save them money on labor costs. And they pass those savings onto you, the policyholder, in the form of a lower premium.

- Outboard motors are also smaller than inboard motors and more common, which means more replacement parts are available, and those parts are often more affordable and require less material to manufacture.

Horsepower is another aspect of a boat’s motor that insurance companies use to assess risk. A higher horsepower motor means that the boat can go faster, which increases the risk of accidents. Insurers charge higher premiums for boats with higher horsepower motors to cover the higher risk that comes with such motors.

Length

Longer boats are more expensive to insure for the most obvious reason: there is more boat to replace.

There’s also the degree of difficulty in navigating a large boat. Longer boats are more likely to be involved in an accident than shorter ones for three reasons:

- Less maneuverability: Longer boats are more difficult to maneuver than shorter boats, which makes them more likely to collide with other boats or objects.

- More blind spots: They also have more blind spots than shorter boats, so the operator has a harder time seeing obstacles.

- More weight: Longer boats weigh more, making them harder to stop and more likely to cause damage in a collision.

In fact, most insurance carriers prohibit any boat above 50 feet in length from a conventional boat insurance policy.

As discussed in our article, “5 Boat Insurance Mistakes First-Time Boat Buyers Make,” the value of the boat and the method you choose to insure based on that value impacts the premium.

The higher your boat’s value, the more expensive it will be to insure it for Agreed Value (if available) compared to Actual Cash Value (ACV).

Factor #3: Your Boating Experience

That brings us to factor 3, which is the length of your boating experience. For boaters who have been on the water since they were too short to see over the wheel when they first took the helm, you’re likely to find yourself with a preferred rate.

But, if you’re new to boating, you present a higher risk and won’t have the privilege of an experience rating.

But not to worry. By completing a New York State-approved boating safety course, you can help reduce your insurance costs. Course completion will demonstrate to your insurer that you’re serious about safety, and you’ll likely qualify for a discount.

Factor #4: The Amount of Insurance Coverage You Choose

A lot has been said about the boat and you, but what about the coverage that protects both?

A lot has been said about the boat and you, but what about the coverage that protects both?

An obvious point is that the more coverage you add, the more expensive the policy will be. Of course, you didn’t come here for such low-level info.

Owners of newer boats (i.e., boats less than 15 years old) often include both comprehensive and collision coverage to protect the vessel against damage. Most of the costs associated here are based on the three factors we’ve already covered.

However, you have some control based on how high or low a deductible you choose. The higher the deductible, the less your premium will be.

Your liability limits also play a role in your premium costs.

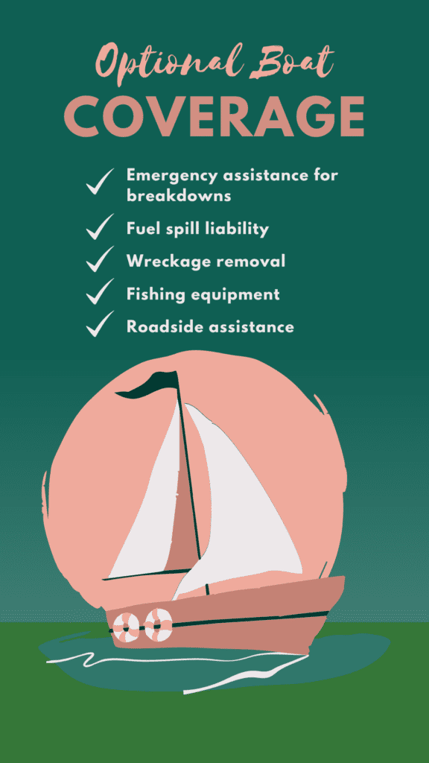

For boaters, it’s the unique optional coverages that significantly move the needle on the insurance premium. Those options include:

- Emergency assistance for breakdowns

- Fuel spill liability

- Wreckage removal

- Fishing equipment, and

- Roadside assistance (towing a boat after your truck breaks down isn’t cheap!)

Can I Save Money by Just Insuring for the Boating Season?

You might think a path to saving money on boat insurance exists in only insuring your vessel during the warmer months. Let’s face it, you’ll have a tough time sailing on frozen CNY lakes.

But there are two reasons why this option isn’t viable:

- Insurance carriers require insurance on seasonal items to be year-round. Canceling the policy early will still leave you responsible for the annual premium. You’d also find it challenging to get coverage from the same carrier the following year. An uninsured period of more than 30 days can cause some insurers to deny new policy requests.

- Your boat can still be damaged when not on the water. Damage while in storage is a leading cause of loss sustained by many watercraft. Weather, fire, roof collapses, vandalism, and theft are all potential ways your boat can be compromised. You’ll want to be insured for those unsettling occurrences while the boat is stored.

Choose Your Boat Insurer and Agent Wisely

Boat insurance differs from one insurer to the next. It is wise to work with an agent who understands the complexities of these unique policies.

We’re well-versed in the differences surrounding policies from competing carriers. So much so we’ve written an article ranking the three best boat insurers for CNY boaters.

Agencies that don’t specialize in the nuances of boating insurance can leave you with a feeling of discomfort and a lack of assurance. You’ll often wonder if you made the right decision whenever you have a close call.

You deserve to get the best value for your money when it comes to boat insurance. We’ll help you connect your new knowledge about cost factors to a policy that’s best for you. That way, you’ll have the tranquility of the water and suitable insurance protection.

If you’re ready to purchase a boat policy tailored to your precious vessel and unique insurance needs, click the Get a Quote button below.

But if you’d rather dip your toe deeper into the boat insurance pool, read “5 Boat Insurance Mistakes First-Time Boat Buyers Make.”

Daniel is an accomplished content creator. He has been working in publishing for almost two decades. Horan Companies hired Daniel as its content manager in November 2022. The agency entrusted its messaging to him. Since then, Daniel has written insurance articles, service and pillar pages, and more. All in an effort to educate CNY readers. He's helping them understand the world of insurance so they can make informed decisions.

Topics:

.png?width=207&height=55&name=Horan_Logo%20Transparent%20No%20Tagline%20(2).png)