Navigating Insurance Challenges for Your CNY Camp: Tips and Insights for Protecting Your Dream Retreat

April 27th, 2023 | 4 min read

Looking for a serene, peaceful property away from the bustling city life in Central New York? It’s not uncommon for people to seek solace in secluded locations like a charming lakeside camp in Tupper Lake or a mountain cabin atop Kaaterskill Creek in the heart of the Catskills.

But before diving in and making this special place a part of your family memories, it’s essential to know how you can protect it against the unexpected.

Insurance availability for secluded camps might be challenging, but realizing this crucial factor now can save you from future heartaches. When financing your camp, lenders require adequate insurance coverage.

As a Baldwinsville insurance agency, we have the advantage of being located between the city and the country. Because of this, we understand the needs and challenges of urban and rural homeowners.

Many of our clients own camps or seasonal properties that require special insurance coverage. We’ve helped them find the best policies for their unique situations. We also know what factors can affect your camp’s eligibility and affordability for the highest level of insurance protection.

Whether it’s the location, the construction, the amenities, or the usage of your camp, we can advise you on how to optimize your insurance options and avoid potential risks.

We want you to value your camp as a place to relax and enjoy nature because you’ve worked hard for that right. That’s why we want to help you protect your dream camp from unforeseen events and insurance obstacles that could ruin your tranquility.

In this article, we’ll walk you through the top challenges that CNY camp owners face when securing insurance and what you can do to avoid potential pitfalls. Understanding these factors and taking proactive steps can help you find the best coverage to protect your dream vacation spot for generations.

The Top Insurance Issues CNY Camp Owners Face

You’ve narrowed down the ideal location for a seasonal camp. It’s not too far from your primary residence, but it’s also isolated enough to offer an escape from the busy urban setting so you and your family can enjoy the peace and quiet of nature.

At some point, you probably asked, “Can I get insurance for my seasonal camp?”

Wise questions like that are why you’re here reading this article. It shows how proactive you are. You don’t want to purchase a rural property you can’t properly insure. And we wrote this article so you can avoid doing just that.

If you intend to finance your camp, your lender will require you to secure a comprehensive insurance policy. But obtaining excellent insurance for remote camps or vacation properties can be quite challenging. In some cases, acquiring even standard insurance can be difficult.

Here are the main challenges camp owners encounter while seeking insurance:

1. Lack of Central Heating

1. Lack of Central Heating

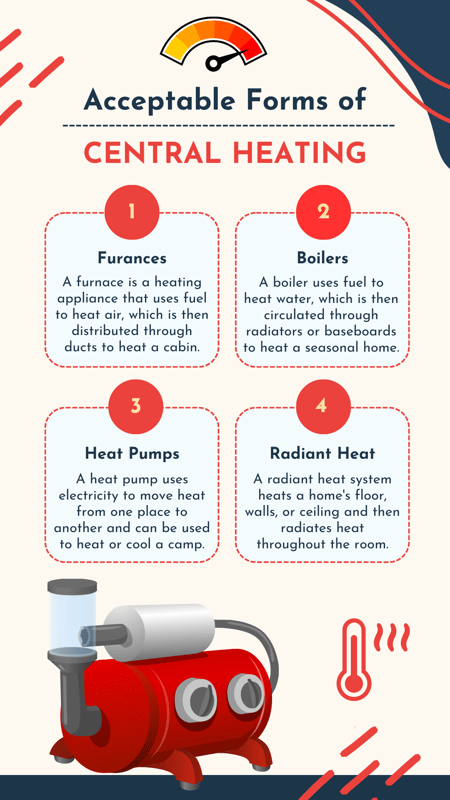

Insurers typically avoid properties without central heating, which is a significant requirement. Central heating systems controlled by a thermostat are preferable. Lack of such heating systems can lead to burst pipes during winter, causing water damage that may go unnoticed for weeks or months.

When discovered, the property may be deemed irreparable, a risk insurance carriers are unwilling to take. Wood or pellet stoves and portable heaters aren’t sufficient solutions as primary heating sources. They can only supplement the central heat but not replace it.

If your camp doesn’t have central heat, you might still get a policy, but it may be limited, and you’ll miss out on many common coverages.

2. Distance from Fire Stations

A house more than five minutes away from a fire station will likely be destroyed by fire. In isolated areas, there are some fire departments, but not as many as in the suburbs. The farther your camp is from a fire station, the harder it will be to find insurers.

If your camp is more than five miles by road (not a straight line) from a fire station, you will have fewer options. At ten miles or more, only a few carriers remain, and they typically charge higher premiums and offer less coverage.

And don’t rely on real estate listings for details about the nearest fire department. Instead, contact the municipal office for accurate information about your designated fire station.

3. No Year-Round Access

Many new camp owners overlook the issue of accessibility throughout the year, primarily because they usually purchase the camp during warmer months. Even if you have central heating and are close to essential facilities like a fire station, having an inaccessible camp during certain seasons can pose major issues.

For example, if your camp is 300 yards from the main road and can only be reached by a long driveway, trying to access it through a foot or more of unplowed snow can be problematic. Additionally, some regions close specific roads during winter, preventing plow trucks from clearing snow.

To avoid headaches and potential insurance coverage difficulties, ensure you have a clear and accessible path to your camp year-round.

4. Camp Condition

Is the camp property somewhat rustic? Keep in mind that many camps were built a long time ago and may not have received the same level of maintenance as a primary residence. While they may be structurally sound, certain elements may not meet current standards.

To obtain the best coverage, be prepared to provide information about the age of the roof and heating system. Wooden roofs over 25 years old can lead some carriers to reduce coverage until a replacement is done. Metal roofs have more leeway but ideally should be under 40 years old.

Heating systems between 20–30 years old might pose issues depending on the carrier. Other factors like siding condition, peeling paint, and unstable decks can result in coverage denial.

If you plan to purchase a property in questionable condition but intend to renovate quickly, there’s no need to worry. We can tailor policies that will cover the property as if the work has already been completed. Feel free to ask us more about this if it applies to your situation.

Don’t wait until the last minute to search for insurance. You may fall in love with a place and then find out that it’s hard to insure or too expensive. To avoid disappointment and frustration, call us before you make an offer.

We can help you understand your options and find the best coverage for your needs. Gaining insight into your insurance options is crucial before committing to any potential investments. It’s better to be prepared and informed than to regret it later.

Don’t Let Insurance Stop You from Owning a Camp in CNY

We hope this article has given you some valuable insights into the insurance issues that CNY camp owners face and how to overcome them. We know how much camp life means to CNY families. It’s a place where you can relax, enjoy nature, and create lasting memories. That’s why you deserve to have the best protection for your investment, along with a sense of tranquility.

As a local insurance agency, we have the experience and expertise to help you find the right coverage for your camp. We work with carriers that specialize in seasonal properties and understand the unique risks and challenges they pose.

We can help you compare quotes, customize your policy, and answer any questions you may have along the way.

Don’t let insurance be an obstacle to your dream of owning a camp in CNY. If you’re ready to insure your dream retreat, click the Get a Quote button below and let us help you make the dream a reality.

But if you’d like to learn more about the unique world of camp coverage, read “3 Critical Coverages to Protect Your Seasonal Camp from Unforeseen Risks.”

Daniel is an accomplished content creator. He has been working in publishing for almost two decades. Horan Companies hired Daniel as its content manager in November 2022. The agency entrusted its messaging to him. Since then, Daniel has written insurance articles, service and pillar pages, and more. All in an effort to educate CNY readers. He's helping them understand the world of insurance so they can make informed decisions.

.png?width=207&height=55&name=Horan_Logo%20Transparent%20No%20Tagline%20(2).png)