NYCM Insurance: The Horan Review

February 15th, 2023 | 6 min read

[Full disclosure: NYCM Insurance is one of our insurance partners. As such, the Horan agency receives commissions for policies NYCM underwrites for our clients. That relationship does not influence our opinions or evaluations of the carrier. What follows is an objective review of a company we chose to partner with for many of the reasons you’ll read below.]

You’ve probably heard little or nothing about NYCM Insurance (or New York Central Mutual), even though they’ve been around for over 100 years.

This review will shed light on what the company is and what it does. Unlike the national carriers whose advertisements are seen far and wide, NYCM concentrates its efforts on a regional footprint, focusing on residents of New York State.

We’ll start with NYCM’s history and highlight a few insurance products and benefits one can expect from the insurer. After you read this review, you’ll be able to decide if they’re a good fit for your insurance needs.

How NYCM Insurance Started

NYCM Insurance was launched in 1899 in a small rural town called Edmeston, located in an agricultural region of Central New York. After a farmer lost his life’s work in a devastating fire, twenty-seven Edmeston residents and business professionals pooled resources to protect other farmers.

They formed New York Central Mutual Fire Insurance Company with founder Van Ness D. Robinson. The insurer started operations in an opera house in Edmeston’s city center, writing premiums amounting to $2,912 in its first year with no losses on the books. And there were just two employees: Van Ness D. Robinson and his wife, Grace, who clerked part-time.

The company more than doubled to five employees by 1917 when it moved operations to a bank building in town. NYCM added homeowners policies in 1956 and auto in 1974. Since 1962, NYCM has occupied a building on the edge of Edmeston that bears its founding year in its address: 1899 Central Plaza East.

The Robinson family has directed NYCM for more than 120 years. Today, the company has New York offices in Edmeston, Buffalo, Sherburne, and Amsterdam. New York Central Mutual rebranded as NYCM Insurance in 2009 and currently employs 800 Central New Yorkers who serve around 500,000 policyholders.

Insurance Policies Offered by NYCM

NYCM offers a wide range of policies in the property and casualty space, including home, auto, umbrella, business, and other insurance products. We’ll explore a few of those policies below, starting with:

Auto Coverage

The usual coverage comes standard with an auto policy from NYCM, as with most insurers. You can explore those coverages in detail by reading our auto insurance overview.

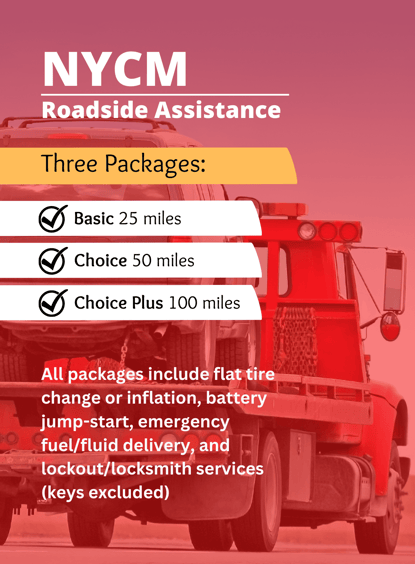

NYCM offers Roadside Assistance through Agero, a company specializing in accident management and digital dispatch solutions. Roadside assistance comes in three package levels:

- Basic, which tows you 25 miles

- Choice, which tows you 50 miles and adds roadside winching

- Choice Plus, which tows you 100 miles and adds roadside winching and complimentary fuel

And according to NYCM, “all packages include flat tire change or inflation, battery jump-start, emergency fuel/fluid delivery, and lockout/locksmith services (keys excluded).”

And according to NYCM, “all packages include flat tire change or inflation, battery jump-start, emergency fuel/fluid delivery, and lockout/locksmith services (keys excluded).”

Policyholders can join NYCM’s Advantage Repair Program, which promises “fast, professional service” from more than 100 Advantage Repair Shops in New York.

Should you suffer an auto accident, once you file a claim (more on that below) and go through the auto repair process, NYCM encourages policyholders to use approved repair shops through the program rather than local body shops as the experience will be more advantageous.

In addition to auto, NYCM offers coverage for classic cars, motorcycles, motorhomes, campers, trailers, and custom vans.

Homeowners Insurance

NYCM’s base homeowners policy comes with the usual coverage:

– Dwelling (also called hazard insurance) pertaining to the main house structure

– Other Structures coverage for detached garages, sheds, and other outbuildings

– Personal Property for certain belongings inside the home

– Loss of Use or additional living expenses in the event your home is rendered uninhabitable during repair or rebuilding efforts

– Personal Liability Protection, in case a guest is injured on your property

– Medical Payments to help pay for medical expenses if a guest is injured on your property

NYCM takes it a step further with its homeowners insurance by offering 150 percent in replacement cost coverage. Also called Extended Replacement Cost, NYCM’s 150 percent policy expands your current dwelling coverage beyond the Coverage A limit listed on your homeowners declaration page.

If you suffer a total loss, NYCM’s 150 percent replacement cost coverage helps buffer extra expenses that may result during the rebuilding phase.

As another option, if you have $300,000 in replacement cost coverage—and meet certain requirements—NYCM also offers what it calls Premier High-Value Protection Coverage, which will go even further in covering rebuilding costs for those willing to pay the fee.

For the personal property portion, while the base is $1,500 on a standard policy, NYCM will go up to $5,000 for loss of jewelry and furs ($5,000 per item and a combined total of $10,000 for the year).

Policyholders with NYCM’s premier coverage also enjoy $10,000 in per item loss of jewelry and furs—barring the need to schedule those items separately in most cases. Loss of firearms and related equipment also goes up to $10,000 per item from a base of $2,500 on a standard policy.

NYCM allows policyholders to add a personal injury endorsement to their homeowners insurance. Some might confuse personal injury with personal liability, but personal injury is more akin to personal offenses you inflict on others.

Personal injury coverage helps protect you in cases of:

- Libel and slander

- Invasion of privacy

- Falsely detaining or arresting someone

- Malicious prosecution

- Wrongful eviction

- And associated legal costs

Pet injury insurance is offered through a homeowners policy up to $1,000.

One Deductible for the Same Loss

A unique feature of NYCM is a bundling perk. If you have a home and auto policy with them, and both your home and vehicle are damaged in a covered claim—say you’re backing out of your garage and forget the door is lowered—you pay one deductible for the two claims.

So, NYCM will charge a $1,000 deductible on the house (or whatever amount you settled on) and waive the collision deductible on the auto.

What is the Claims Process Like for NYCM Insurance?

The Horan agency has found NYCM to be fair and prompt with claims. Their staff is professional, capable, and accommodating at every stage.

If you encounter an auto accident, you can report it through NYCM Insurance or by contacting your independent agent, who already knows the claims process. Once the claim is initiated, an NYCM claims department representative will contact you and take it from there.

If you are part of the Advantage Repair Program, NYCM will send your information to the Advantage Repair Shop you choose. They will prioritize your vehicle repair when you arrive, and NYCM will issue payment to the shop directly.

Be it an auto, home, or another claim, NYCM strives to make the post-accident or covered peril experience as hassle-free as possible for its policyholders.

NYCM’s Awards and Other Highlights

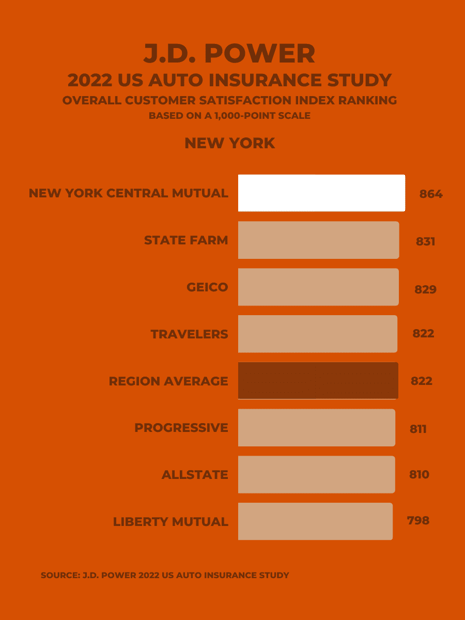

The marketing information services firm JD Power—specializing in consumer surveys and customer satisfaction research—ranked NYCM as the number one auto insurer for customer satisfaction in New York in 2022. JD Power also considers the company best in price.

The marketing information services firm JD Power—specializing in consumer surveys and customer satisfaction research—ranked NYCM as the number one auto insurer for customer satisfaction in New York in 2022. JD Power also considers the company best in price.

NYCM won a 2022 Gold Stevie Award for achieving customer service excellence in the financial services sector. It was the sole insurance company to win among a number of investment firms.

AM Best, a US rating agency that provides ratings and financial data on insurers and other financial institutions, consistently rates NYCM an A in terms of financial strength. It also views NYCM as a stable long-term issuer of credit.

Charitable Efforts

Underwriting team member Jodi Hawes founded an in-house program called Helping Hands in 1999. Jodi and her team spent the next two decades giving to more than 250 families in need throughout Chenango, Oneida, Herkimer, Madison, and Otsego counties.

To maximize the giving, NYCM partnered with the Otsego County Department of Social Services, Edmeston’s West Hill Terrace (affordable housing), Edmeston Rotary, West Winfield Rotary, UV Central School, Brookfield Central School, Harding Nursing Home, Chase Nursing Home, Upstate Cerebral Palsy, and the non-profit Integrated Community Alternatives Network (ICAN).

In light of NYCM’s awards and charitable giving, and considering its various policy offerings, one still has to ask:

Is NYCM Insurance Right for Me?

Good Fits

NYCM is an excellent choice for New Yorkers looking for an insurer dedicated to providing superior customer service. NYCM promises the availability of its customer service reps via phone 24 hours a day, 7 days a week for the entire year.

For Central New Yorkers who desire low deductibles on their homeowners policy, NYCM goes as low as $100, well below competing carriers.

And if discounts are your thing, NYCM may be a good fit for you. They offer discounts galore, such as:

- Claim-Free Discount

- Gated Community Discount

- Good Student Discount

- Green Discount

- Low Mileage Discount

- Home Buyer Discount

- Multi-Policy Discount

- New Car Discount

- Renovation Discount

- Retirement Discount

- Work from Home Discount

We could list more, but we’ve run out of space!

Not-so-Good Fits

That leads us to reasons why a New Yorker would not be a good fit for NYCM. For starters, whatever you’re insuring must be located in the state of New York. Otherwise, you cannot purchase insurance from the carrier.

Do you have a pit bull or a pit bull mix? NYCM will cap your personal liability coverage at $100,000, which restricts purchasing a personal umbrella policy. That’s probably not a good fit for owners of these dog breeds.

If you’ve had a DUI conviction in the previous seven years, NYCM may not be a good fit for you.

If you use your vehicle to deliver food for companies such as Grubhub and Doordash, NYCM won’t be a good fit for your insurance needs.

Have you had more than one home claim in the last five years? You’re likely going to have to look elsewhere for homeowners insurance.

If you’re thinking of buying direct from NYCM, they won’t be a good fit because the carrier sells policies exclusively through its network of independent agents.

That said, NYCM Insurance has been a reliable insurer for over 100 years, and the company doesn’t plan to slow down. The Horan agency partnered with NYCM because we believe they’re a good fit for us. After reading this review, you may decide they’re a good fit for you.

If you’d like to read more Horan Reviews on carriers that serve the Central New York region, click the links below. We’ll add more review links as they become available.

- Dryden Mutual Insurance Review

- Erie Insurance Review

- Main Street America Insurance Review

- Progressive Insurance Review

- Sterling Insurance Review

- Travelers Insurance Review

If you’re ready to see a quote from NYCM Insurance or other insurers in our network, click the Get a Quote button below, and one of our insurance specialists will reach out to you.

Daniel is an accomplished content creator. He has been working in publishing for almost two decades. Horan Companies hired Daniel as its content manager in November 2022. The agency entrusted its messaging to him. Since then, Daniel has written insurance articles, service and pillar pages, and more. All in an effort to educate CNY readers. He's helping them understand the world of insurance so they can make informed decisions.

Topics:

.png?width=207&height=55&name=Horan_Logo%20Transparent%20No%20Tagline%20(2).png)