Protecting Your Investment: Why Landlord Insurance is Essential for Rental Property Owners in Central New York

May 5th, 2023 | 4 min read

Embarking on the journey of becoming a residential landlord can be a rewarding experience, as it allows you to build wealth and create an additional income stream. As you take your first steps into this new venture, it’s crucial to understand the importance of properly insuring your rental property.

If you’ve decided to rent out your CNY property to tenants, you might think that your existing homeowners insurance policy will cover you in case of any damage or liability. However, this is a common misconception that can cost you a lot of money and headaches.

Homeowners insurance is designed for owner-occupied properties, not rental properties. You need a special type of insurance policy called landlord insurance to protect your investment and yourself as a landlord.

The Horan agency has spent years helping landlords find the best insurance policies for their rental properties throughout Central New York. We understand the unique risks and challenges landlords face, and we can tailor a policy that suits your budget, needs, and situation.

We know that being a landlord is not easy. You may have to deal with maintenance issues, tenant disputes, legal matters, and unexpected expenses. For that reason, you require a distinct level of coverage that caters to the unique risks you face.

That’s why we want to make sure you have the peace of mind that comes with having a reliable and affordable landlord insurance policy.

In this article, we will explain the main differences between homeowners and landlord insurance policies and why you need the latter if you’re renting out your property.

Why You Need Landlord Insurance Instead of Homeowners Insurance

Renting out your property can be a smart way to increase your income and grow your wealth. But if you are new to being a residential landlord, you need to understand how to protect your investment with the right insurance.

An inappropriate insurance policy can have severe consequences on your rental property.

For instance, a homeowners policy not only lacks the necessary coverage for a landlord, but it also contains numerous loopholes that can lead to claim denial. However, these potential issues can be avoided with landlord insurance, as it offers more coverage and benefits for landlords.

The following sections will highlight the key distinctions between a landlord and a homeowners insurance policy to help you make an informed decision.

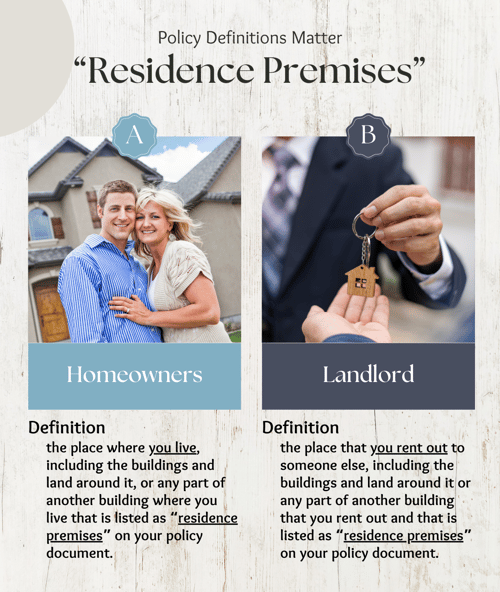

Policy Definitions Matter

Policy Definitions Matter

Insurance policies have different parts that explain what they cover and what they don’t. One of these parts is called “Definitions.” It tells you how certain words or phrases are used in the policy.

One of these phrases is “Residence Premises.” Both homeowners and landlord insurance policies use this phrase, but it has different meanings in each policy.

- Homeowners: It means the place where you live, including the buildings and land around it, or any part of another building where you live that is listed as “residence premises” on your policy document.

- Landlord: It means the place that you rent out to someone else, including the buildings and land around it or any part of another building that you rent out and that is listed as “residence premises” on your policy document.

According to the above definitions, if you have a homeowners policy and you move out and rent your place to someone else, your policy will not cover you anymore. This is because you have changed the meaning of “residence premises” by renting it out. You need a landlord policy to cover your rental property instead.

Personal Property Coverage

A homeowners insurance policy typically provides extensive personal property coverage, often amounting to hundreds of thousands of dollars. This is reasonable because your belongings are generally stored in your home. However, if you rent the house without furnishing it, such high coverage is not necessary in your landlord policy.

You can include personal property coverage for items such as lawn mowers or appliances if you prefer. Alternatively, you can choose to exclude personal property coverage altogether.

Understanding Coverage D

As a landlord, you should pay attention to Coverage D. This is the part of the policy that covers your loss of income if your rental property is damaged by an insured event and your tenant has to move out while it is being fixed.

On a homeowners insurance policy, Coverage D is called Loss of Use. It only applies if you have to live somewhere else because of the damage. But on a landlord policy, Coverage D is called Loss of Rent. It compensates you for the rent payments you would miss out on because of the damage.

This is why having a landlord policy can make a big difference in your income!

Comparing Costs

A landlord insurance policy is usually more expensive than a homeowners insurance policy for the same property. This is because a rental property has more risk for the carrier.

The insurer assumes that the owner of a home will take care of any problems that arise. But a tenant might not report or fix any issues that could cause more damage later. This makes it more likely that the carrier will have to pay for a claim.

Even though a landlord policy costs more than a homeowners policy, it’s worth it because it offers more protection and benefits for landlords. A landlord policy can cover you for things like loss of rent, liability lawsuits, vandalism, and malicious damage by tenants.

These are things that a homeowners policy would not cover or would have very limited coverage for. A landlord policy can save you from losing money and facing legal troubles if something goes wrong with your rental property. It’s a smart investment that can help you cope with tenant-related challenges while creating financial security.

Let Us Help You Get the Coverage Your Rental Property Needs

As a landlord, you have a lot of responsibilities and liabilities that a regular homeowners policy can’t cover. Rather than an existing homeowners policy, you need a landlord policy that offers more coverage and benefits for your rental property and your tenants.

Being a landlord comes with its fair share of challenges, such as dealing with maintenance, tenant issues, and legal matters. We understand these difficulties, and as an experienced insurance agency, we’re here to help you navigate the complexities of protecting your investment.

Having the right insurance coverage specific to your needs as a landlord will relieve stress and allow you to focus on your business. Let us use our expertise and years of experience to find the best landlord insurance policy tailored to your unique situation so that you can move forward with confidence.

To get things started, click the Get a Quote button below, supply us with a few details, and one of our insurance specialists will reach out to you.

If you’d rather continue your landlord insurance learning journey, read “10 Common Mistakes New Landlords Make When Purchasing Insurance and How to Avoid Them.”

Daniel is an accomplished content creator. He has been working in publishing for almost two decades. Horan Companies hired Daniel as its content manager in November 2022. The agency entrusted its messaging to him. Since then, Daniel has written insurance articles, service and pillar pages, and more. All in an effort to educate CNY readers. He's helping them understand the world of insurance so they can make informed decisions.

.png?width=207&height=55&name=Horan_Logo%20Transparent%20No%20Tagline%20(2).png)