Auto Liability Coverage Limits Explained

January 24th, 2023 | 4 min read

Many Central New Yorkers purchase insurance policies without a second thought. Because of that, they don’t fully understand some of the policy details involved.

One of those details is an auto policy’s liability coverage limits. You can think of coverage limits like a ceiling. Insurance carriers pay out sums no higher than those figures to cover damages you have caused (such as up to $100,000 to another driver who suffers bodily injury during a crash, if that’s your policy limit).

If you don’t have enough liability coverage, an auto accident may cost far more than you can afford. That’s why it pays to understand how liability coverage limits work and what amount of coverage you need in preparation for unforeseen accidents.

The Horan agency has helped many clients understand their auto liability coverage limits, and we can help you do the same.

So in this article, you’ll learn how to review your coverage details. You’ll walk away with a proper understanding of your auto policy so that you will be prepared to make adjustments to your liability coverage limits that can prevent you from paying large sums out of pocket in the event of an accident.

What Liability Coverage Looks Like

Liability coverage is perhaps the primary element of your auto policy, which is why you’ll often find it listed first on your policy’s declarations page.

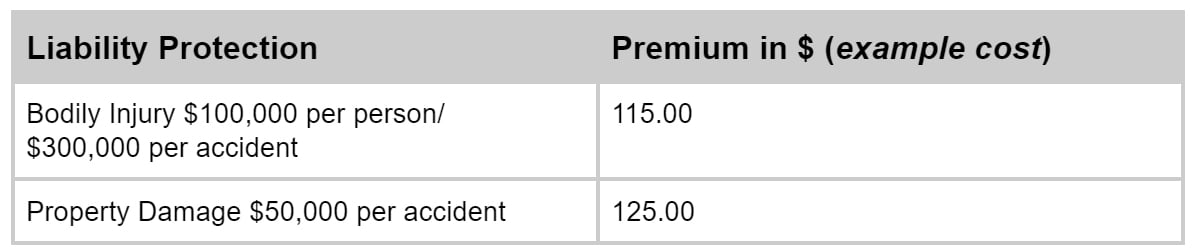

Liability coverage comes in two parts: bodily injury liability and property damage. Bodily injury liability shows payout limits for each accident and each person injured in an accident. The per-accident payout limit for property damage is also listed. (See example below):

Other types of coverage may include limits for uninsured/underinsured motorists and personal injury protection (PIP), which covers the medical expenses resulting from an accident regardless of who is at fault. For that reason, personal injury protection is called “no-fault insurance.”

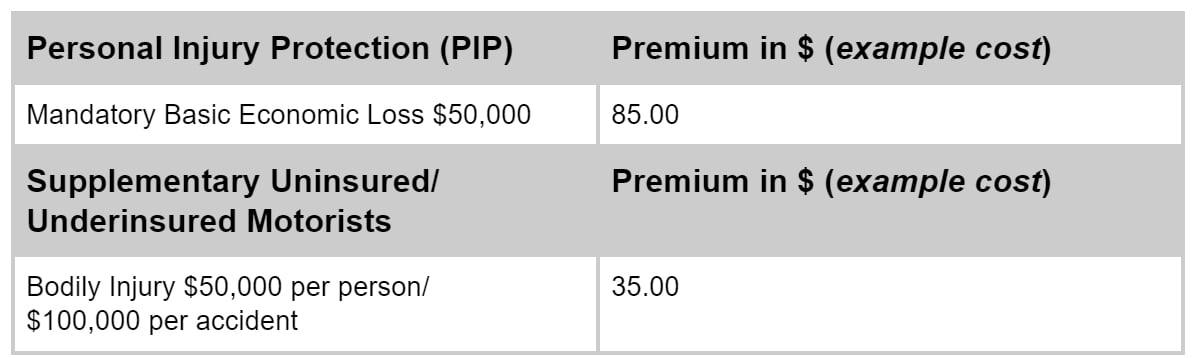

PIP and uninsured/underinsured motorist limits can look like the following:

As you can see in the above examples, coverage liability limits appear alongside each listed coverage item. Payouts for accidents and bodily injuries resulting from those accidents won’t exceed the coverage limits listed on your policy. It’s your responsibility to pay damages out of pocket beyond your coverage limits.

That reality can be overwhelming for those who are not flush with cash. An auto accident can quickly burn through your savings if you opt for low liability coverage limits or state minimums. To avoid being caught in a situation that requires substantial finances—such as an unexpected motor vehicle accident—it’s crucial to learn how coverage limits function.

With that understanding, you can routinely examine your auto policy to assess whether the liability coverage limits are adequate. If you need more coverage, spending more upfront to increase your limits can offer financial protection and save you large sums in the long run.

Why Do I Need Liability Coverage?

For starters, if you live in Central New York and are a licensed driver who owns a motor vehicle in the state, you’re required to purchase liability coverage. But that’s a good thing. Liability coverage helps pay for victims’ healthcare expenses arising from accidents you cause. That is part of the bodily injury portion, which includes lost wages and pain suffered by the other driver and their passengers. But there’s more.

Bodily Injury Liability—What’s Covered?

- Healthcare and funeral expenses for accident victims injured or killed by the policyholder—when all PIP/no-fault coverage has been “exhausted” or used up

- The policyholder’s legal expenses arising from an auto accident lawsuit

- Loss of income for all victims of an accident the policyholder caused

- Payouts for pain and suffering victims experienced due to an accident the policyholder caused

As stated, payouts from your liability coverage also extend to property damage you cause. Per the Department of Motor Vehicles (DMV), the current New York State required minimums for liability coverage stand at these numbers.

- $10,000 for property damage for a single accident

- $25,000 for bodily injury and $50,000 for death for a person involved in an accident

- $50,000 for bodily injury and $100,000 for death for two or more people in an accident

Liability Coverage Limits in Action

Let’s see how these state minimums work in a real-world scenario.

A Brewerton resident named Bill is driving along Route 31 in Cicero, New York. Another vehicle ahead of him stops abruptly when a deer sprints across the road. Bill stomps the brake pedal too late to avoid the impact. The driver of the other vehicle, Debbie, is injured, along with two of her passengers.

Bill purchased liability coverage at the required minimum level for New York State, so he had a $10,000 limit for property damage, a $25,000 limit for each person injured, and a $50,000 maximum for the accident.

In our scenario, Debbie’s brand-new $70,000 electric vehicle sustained $30,000 in damage. That’s $20,000 above Bill’s policy limit. Meanwhile, Debbie and her two passengers hired separate lawyers and were awarded $15,000 each for pain and suffering.

Bill’s policy limit of $25,000 per person and $50,000 per accident covers those expenses, but $20,000 of the $30,000 vehicle repair cost has to come out of pocket. Yikes!

If Debbie and her passengers were awarded more money in their lawsuit, the costs would likely exceed Bill’s coverage limits, which means more out-of-pocket payments. But increasing liability coverage limits above the state minimums allows Bill to avoid dipping into his savings and selling assets to cover it all.

Many drivers increase their property damage limits to $50,000, but at Horan, we’ve seen that $100,000 is the most common limit for property damage coverage. While $100,000 is sufficient to cover most road mishaps, it often results in a minimal premium increase on an auto policy.

Uninsured/Underinsured Motorist Coverage Limits

Another type of liability coverage to note is uninsured/underinsured motorist coverage, which helps pay for injuries and damages you incur in an accident due to a driver with insufficient insurance or no insurance.

As a Central New Yorker with this coverage, you can collect against your own policy if an uninsured/underinsured motorist significantly injures you.

For example: say Angela’s sedan is hit from behind, and she’s left with permanent spinal injuries. The driver of the truck that struck her vehicle leaves the scene (or stays, but he only has $25,000 in bodily injury coverage). Angela could use her uninsured/underinsured coverage to compensate herself.

Accident victims in New York benefit from uninsured/underinsured motorist coverage because it eases the cost burden in such cases.

New York State requires drivers to carry uninsured motorist coverage, but not the underinsured portion. At Horan, we combine uninsured and underinsured motorist coverage to offer our clients more protection against the percentage of drivers who choose to operate vehicles with insufficient insurance coverage.

Review Your Auto Insurance Coverage Periodically

Once you understand auto liability coverage limits, review your policy periodically, such as every six months. Determine whether your financial situation is in line with your current coverage limits. If an accident occurs, your policy limits should be high enough to cover potential damages so that your assets—all or most of them—are safeguarded.

Now that you’ve learned about auto liability coverage limits, read our article How Do Deductibles Work for Car Insurance? to find out how much you should be paying out of pocket for comprehensive insurance, collision coverage, and other portions of your auto policy.

And if you’re thinking about updating your current auto coverage or purchasing a new auto policy, call (315) 635-2095, and one of our insurance specialists will be happy to help. Or use our contact form to get in touch.

Daniel is an accomplished content creator. He has been working in publishing for almost two decades. Horan Companies hired Daniel as its content manager in November 2022. The agency entrusted its messaging to him. Since then, Daniel has written insurance articles, service and pillar pages, and more. All in an effort to educate CNY readers. He's helping them understand the world of insurance so they can make informed decisions.

Topics:

.png?width=207&height=55&name=Horan_Logo%20Transparent%20No%20Tagline%20(2).png)