New York Workers Comp Explained: A Comprehensive Guide for CNY Employers

August 21st, 2023 | 10 min read

You’re a new business owner in New York State. You want to run your business well. But you may not know some of the things you have to do as an employer in this state. One of these things is obtaining workers’ compensation insurance. This is a kind of insurance that pays for your employees if they get hurt or sick at work.

You have to buy this insurance by law. But it’s also a smart investment for your business. It can save you from legal problems, money losses, and a poor reputation. It can also provide benefits and support for your employees.

But workers’ compensation insurance is not easy to understand. It has different rules for different businesses, employees, and situations. You may not know how to choose the best policy for you, how much to pay, or how to follow the law. You may also have problems with fraud, audits, or claims.

We can help you with that. Horan is an experienced CNY insurance agency. We specialize in workers’ compensation insurance and other business insurance solutions. We can teach you

- the basics of workers’ comp

- the specific requirements for your business, and

- the benefits of having a good policy

In this article, we’ll tell you what workers’ compensation insurance is, why you need it, and how it works. We will also address concerns new business owners have about workers’ comp. We’ll give you tips and resources to help you make smart choices and avoid mistakes. After reading this article, you’ll know more about workers’ comp and how it can help your business.

CLICK LINKS BELOW TO JUMP TO SECTION

What is Workers’ Compensation Insurance?

What Workers’ Comp Does and Doesn’t Cover

Workers’ Comp Rates Explained

How Your Business Age Affects Your Workers’ Comp Options

How Your Claims Affect Your Workers’ Comp Rates

How Workers’ Comp Audits Work

A Workers’ Comp Audit in Action

The Workers’ Comp Problem with 1099 versus W2 Employees

Start Protecting Your Employees with a Workers’ Comp Policy

What is Workers’ Compensation Insurance?

Workers’ compensation is a type of business insurance. It covers your employees if they get injured or sick because of their work. It pays for their medical expenses, lost wages, and other benefits. It also protects you from employee lawsuits arising from work-related injuries or illnesses.

New York State law requires most employers to have workers’ compensation insurance. You have to buy it from a private insurance company or the State Insurance Fund. You can also work with an insurance agency like Horan. You have to pay the premiums like other insurance policies. Insurance premiums are higher for riskier lines of work because the risk of loss is higher.

Once established, you report any injuries or illnesses to the carrier. The carrier will then notify the Workers’ Compensation Board. The Board is a state agency that oversees the workers’ compensation system. It ensures fair distribution of benefits for both employees and employers. It also encourages adherence to the law.

What Workers’ Comp Does and Doesn’t Cover

Workers’ compensation insurance covers most types of workers. The list includes full-time, part-time, temporary, and seasonal employees. It also covers some volunteers and independent contractors, depending on the situation. And some workers are not covered by workers’ compensation insurance. That includes federal employees, domestic workers, farm workers, and clergy.

Workers’ comp covers most types of injuries and illnesses that happen because of work. It doesn’t matter who was at fault or how the injury or illness happened. Some injuries and illnesses aren’t covered by workers’ compensation insurance. Among them are those that result from intoxication, self-harm, or illegal activities.

Workers’ compensation insurance provides different types of benefits for your employees. It depends on the severity and duration of their injury or illness. These benefits include:

- Cash benefits. Workers’ comp pays some of your employees’ lost pay. This happens if they can’t work for more than seven days because of their injury or sickness. The cash benefits depend on how much your employees make and how disabled they are.

- Medical care. Your employees need medical care and drugs for their work injury or sickness. Workers’ compensation insurance pays for all the necessary treatment and medication. Your employees can pick their own doctor or provider if the Board approves them.

- Disability benefits. Workers’ comp pays for the long-term effects of your employees’ work injury or sickness. This includes physical impairments, mental disorders, and reduced earning capacity.

- Vocational rehabilitation. Workers’ comp covers the training and services your employees need to return to work. This includes career counseling, job placement, and education.

- Death benefits. Workers’ comp pays benefits to the family of a worker who dies from a work injury or sickness. These benefits include funeral costs and part of the worker’s pay.

- Legal expenses. Workers’ comp pays the legal fees of your employees who go to court for work-related issues. This includes hiring a lawyer, filing documents, and paying witnesses.

Workers’ Comp Rates Explained

Workers’ comp rates are the prices you pay for workers’ comp insurance. They depend on how risky your business and your employees’ jobs are. The riskier your business and employees’ jobs, the higher your workers’ comp rates will be.

Workers’ comp rates depend on the work your employees do. Each type of work has a code and a rate.

Workers’ comp rates are also based on the payroll of your employees. The payroll is the total amount of money you pay to your employees.

But there’s a catch. With workers’ comp, they base payroll on the riskiest thing your employees do for you. It doesn’t matter how often or how long they do it. The moment they do something risky, their whole payroll will move to a pricier class.

Let’s look at an example. Say you own a piano store in Watertown, New York. You have a salesperson who walks the floor and talks to potential customers. He lets them sit down and play various pianos, organs, and keyboards. This part of his job involves little risk. The code for this type of work is, let’s say, 8017, and the rate is $1.86 per $100 of payroll.

The workers’ comp premium for an employee earning $50,000 per year would be $930. You calculate this by multiplying the annual wage by the rate and dividing by 100.

But sometimes, the salesperson also moves the pianos around the showroom floor. Now he’s doing furniture moving as part of his job. This task involves more risk. He can hurt his back or his foot by lifting something heavy. The code for this type of work is 8293, and the rate is $12.46 per $100 of payroll.

Now, you may think that you only have to pay $12.46 per $100 of payroll for the time that the salesperson moves the pianos. But that’s not how it works. With workers’ comp, you have to pay $12.46 per $100 of payroll for all the time that the salesperson works for you. Even when he is walking and talking, they will class his payroll as furniture moving.

That is a big difference. If the salesperson makes $50,000 a year, you have to pay $930 a year for workers’ comp insurance if he only walks and talks. But if he also moves pianos, you have to pay $6,230 a year for workers’ comp insurance.

Note that this fictitious example bases the premium on the payroll alone. There are still other fees and costs added to the policy. That means the total bill will be more than $6,230!

That’s why it’s important to know what type of work your employees do and how risky it is. It can affect how much you pay for workers’ comp. Each carrier rates the classes according to their own criteria. There is no universal class rate. You have to contact an agent for an accurate rate.

How Your Business Age Affects Your Workers’ Comp Options

Workers’ comp options are the choices you have for buying workers’ comp insurance. You may want to compare different options to find the best one for your business. But not all options are available for all businesses. Some options depend on how long you’ve been in business.

If you are new in business, you may have fewer options for workers’ comp insurance. This is because most major insurance carriers want to see your loss history. This shows the number and cost of your employees’ work-related injuries or illnesses. The insurance carriers use it to measure your business risk and set your rates.

Most major insurance carriers want to see at least three years of loss history. If you’ve been in business for less than three years, they may not offer you a policy. They may think that your business is too risky or unpredictable. They may also have other criteria that you do not meet, such as your industry, location, or size.

If you’re new in business, you may have to seek other opportunities. That means smaller insurance carriers or the New York State Insurance Fund (NYSIF). Smaller insurance carriers may be more willing to take a chance on new businesses.

But they may also charge higher rates. NYSIF is a public insurance carrier. It has to provide workers’ comp insurance to any employer who wants it. But it may also have some drawbacks, such as limited discounts, strict audits, or slow claims.

Being new in business doesn’t mean you can’t get good workers’ comp insurance. It means you have to work harder to find it. You may have to shop around, compare quotes, and negotiate terms. You may also have to improve your safety practices and reduce your claims.

And do your best to build your reputation. As your business grows and matures, you may have more options. This will result in better rates for workers’ comp insurance.

How Your Claims Affect Your Workers’ Comp Rates

Your claims are the requests you make to your carrier when your employees get injured or sick at work. Your claims show how much money your insurer has to pay for your employees’ benefits.

Your claims affect your workers’ comp rates. The more claims you have, the higher your rates will be over time. This is because your insurance company has an opinion about your business. They think that your business will have more injuries or illnesses in the future. So, they charge you more to cover their costs and risks.

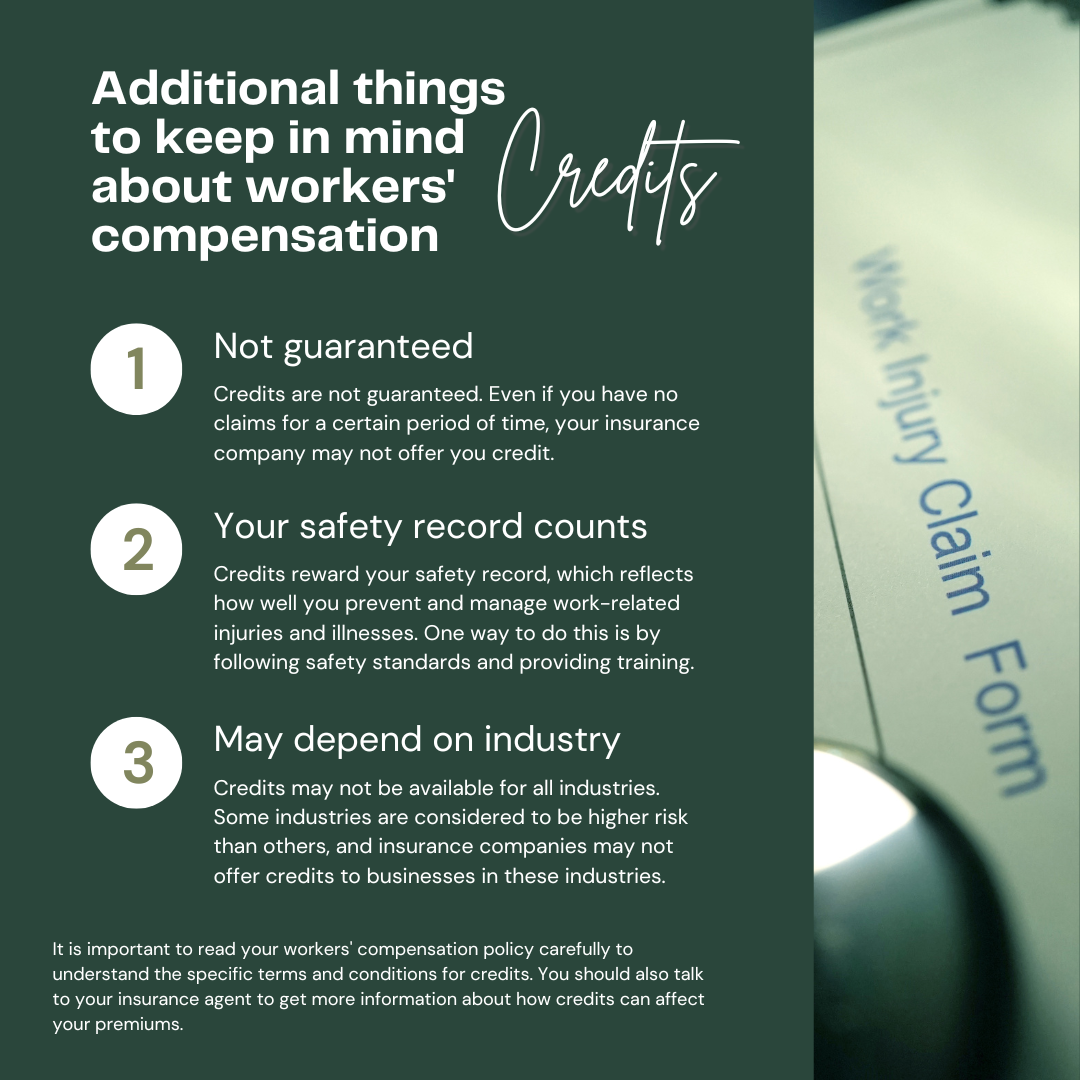

But if you have no claims, you may get a credit. A credit is a discount or a refund that your insurance company gives you for being a good customer. A credit can lower your workers’ comp rates and save you money. You may get a credit if you have no claims for a certain period of time, such as a year or more.

That’s why it’s important to prevent and reduce your claims. You can do this by making your workplace safer and training your employees. You can also report and treat any injuries or illnesses immediately. And work with your insurance company to manage your claims and avoid any disputes or delays.

How Workers’ Comp Audits Work

Workers’ comp audits are reviews your insurer does each year to check your payroll and claims. They do this to make sure that you’re paying the right amount of premium for your workers’ comp insurance.

Workers’ comp audits happen aruond your policy’s renewal date. This is the date when your policy expires and you have to renew it. So, if your policy’s renewal date is June 1, your insurance company will do an audit each year around that time.

When your insurance company does an audit, they will ask you to provide some information. You’ll show them how much payroll you had last year. You’ll also show them proof of your payroll and claims, such as tax forms, payroll records, or claim reports.

Your insurer will use this information to compare your payroll and claims. They estimated these numbers when they set up your policy. They’ll see if there is any difference between what they expected and what actually happened.

If there is no difference, or if the difference is small, you don’t have to worry. Your premium will stay the same or have a slight change. You may even get a credit if your payroll was lower than expected.

But if there is a big difference, you may have to pay more or less premium. This can happen if your payroll or claims were higher or lower than expected by a lot.

A Workers’ Comp Audit in Action

For example, say you’re a new business and you estimated your payroll at $86,000 when you bought your policy. Your insurance company set up your policy based on $86,000. But when they did the audit, they found out that your payroll was actually $118,000 last year.

That’s $32,000 more than what they expected.

Now, your insurer will adjust your premium based on $118,000 instead of $86,000. They’ll charge you more premium for last year and for the next year. You’ll have to pay the difference for last year and a higher rate for the next year.

This can be a problem for you if you’re not prepared. You may have to pay a lot of money at once or in installments. You may also have to adjust your budget and cash flow for the next year.

That’s why it’s important to keep track of your payroll and claims throughout the year. You should also report any changes in your business or employees to your carrier as soon as possible. This can help you avoid surprises and problems when the audit comes.

The Workers’ Comp Problem with 1099 versus W2 Employees

The workers’ comp law applies to most types of workers, regardless of how you pay them. It doesn’t matter if you call them

- 1099 contractors,

- freelancers, or

- independent contractors.

What matters is the nature of the work they do and the degree of control you have over them.

They are your employees for workers’ comp purposes. This is true if you direct and supervise them and their work is part of your regular business activity. This means that you have to provide workers’ comp insurance for them or face penalties and fines.

The only way to avoid this obligation is if your 1099 workers have their own workers’ comp policies. In other words, they have to buy their own insurance from a private company or from the State Insurance Fund. They have to pay the premiums themselves, and they have to show proof of coverage to you.

If they don’t have their own policies, you have to get one for them.

But getting a workers’ comp policy for your 1099 workers may not be easy. Many insurers are not willing to sell policies to employers who only pay 1099 wages. They prefer employers who pay W2 wages because they can see and track them with more ease. W2 wages are more reliable and predictable than 1099 wages, which can vary based on the work done and time spent. Insurers use W2 wages to calculate premiums and benefits for workers’ comp policies. 1099 wages make this process more difficult and risky.

So what can you do as a business owner in Central New York who pays 1099 wages? You have three options:

- You can switch to paying W2 wages instead of 1099 wages. This may make it easier for you to get a workers’ comp policy for your workers. And it may also save you money on taxes and other expenses. Your payroll costs and responsibilities may also increase. Think withholding taxes, paying social security and Medicare, and providing other benefits.

- You can make sure that your 1099 workers have their own workers’ comp policies. This may save you from having to buy a policy for them. It may also protect you from liability if they get injured or sick at work. But it may also reduce your pool of available workers. That’s because most 1099 contractors won’t have their own policies. Nor are they willing to buy them.

- You can do a combination of switching to majority W2 workers and limiting 1099 workers. Paying 1099s is cash labor. Carriers want you to keep cash labor at a small percentage. But the first suggestion on this list is the preferred option.

Start Protecting Your Employees with a Workers’ Comp Policy

You’ve learned a lot about workers’ compensation insurance in this article. You know what it is, why you need it, and how it works. You also know the benefits it provides for your employees and your business. And you know the challenges and risks you may face as a new business owner in New York State.

Workers’ compensation insurance is not something you can ignore or avoid. It’s a legal obligation and a smart investment for your business. It can protect you from lawsuits, losses, and reputation damage. It can also help your employees recover from work injuries or illnesses and return to work.

But workers’ compensation insurance is not simple or easy. It has many rules and requirements that vary by business, employee, and situation. You may have questions or problems that are not covered in this article. You may need more guidance and support to make the best decisions for your business.

That’s why we’re here to help. We can find the best insurance plan, price, and discount for your needs and goals. We can also show you how to apply, pay, and manage your insurance and how to deal with any issues or claims.

Are you ready for a free quote and consultation on workers’ compensation insurance? Click the Get a Quote button below. We’ll help you get the coverage you need at the price you can afford. We’ll also help you manage your policy and claims with ease and confidence. We’ll be your partner in protecting your business and your employees.

Daniel is an accomplished content creator. He has been working in publishing for almost two decades. Horan Companies hired Daniel as its content manager in November 2022. The agency entrusted its messaging to him. Since then, Daniel has written insurance articles, service and pillar pages, and more. All in an effort to educate CNY readers. He's helping them understand the world of insurance so they can make informed decisions.

Topics:

.png?width=207&height=55&name=Horan_Logo%20Transparent%20No%20Tagline%20(2).png)