Car Insurance For Your Teen Driver: What Every CNY Parent Needs to Know

May 18th, 2023 | 8 min read

If you have a newly licensed teen driver in the family or a teenager about to get their driver’s license, you might be feeling a mix of emotions. You’re proud of their achievement but also worried about their safety and the cost of insuring them.

Getting your teenager ready to drive can be a stressful and expensive process. You want them to be safe and responsible, but you also don’t want to pay a fortune for their car insurance.

We understand what you’re going through.

We’ve helped many CNY parents like you navigate the complex and confusing world of car insurance for young drivers and find the best balance between coverage and cost. We’re here to do the same for you.

Many parents are unaware of how adding a teen driver to their car insurance policy can affect their rates and coverage options. This is understandable, as car insurance can be a complicated and confusing topic.

However, being uninformed can also lead to costly mistakes and unpleasant surprises. That’s why it’s important to educate yourself on the basics of car insurance for teens and how to make the best decisions for your family.

The fact that you’re reading this shows what a proactive and caring parent you are. So, kudos to you!

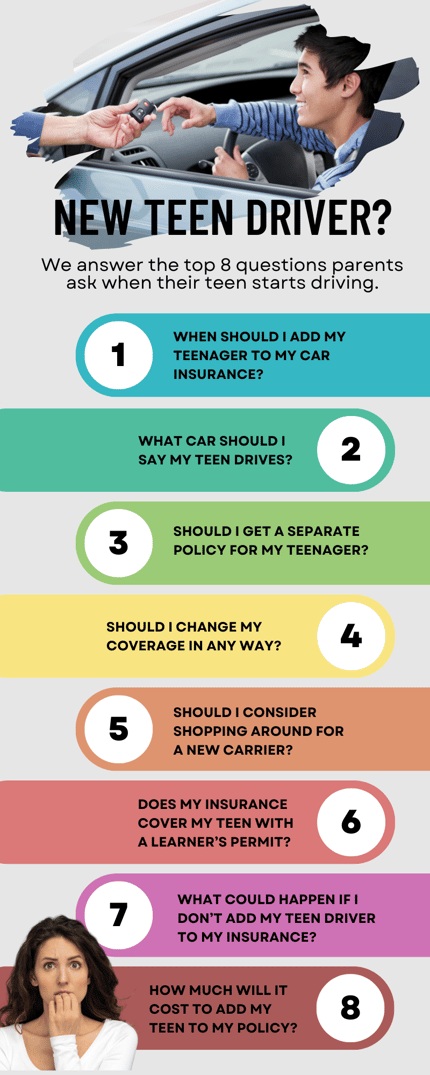

In this article, we’ll answer some common questions that parents have when their teen starts driving, such as:

- When should I add my teenager to my car insurance?

- What car should I say my teen drives?

- Should I get a separate policy for my teenager?

- Should I change my coverage in any way?

- Should I consider shopping around for a new carrier? And more!

By the end of this article, you’ll have a better understanding of how to handle your teen’s driving situation and how to save money on your car insurance. Let’s get started!

1. When Should I Add My Teenager To My Car Insurance?

One of the most important steps you need to take when your teenager passes the written test, receives a learner’s permit, and starts driving is to contact your insurance agency or carrier.

Immediately!

They will let you know when to add your new teen driver to your car insurance policy.

Some insurance companies, such as Progressive Insurance, require you to list your teen if they have a learner’s permit. Other companies, such as Erie Insurance and NYCM, only need you to list your teen after they get their license.

Either way, you should check with your agent or insurer before your teen starts driving.

However, adding a teen driver to your policy can increase your rates significantly, as insurance companies consider them high-risk drivers due to their lack of experience.

Therefore, you need to know when and how to add your teenager to your car insurance and what factors can affect the cost.

But this is discussed in greater detail in a later section.

2. What Car Should I Say My Teen Drives?

The car your teen drives can have a big impact on your insurance rates.

Different cars have different values and risk levels, which affect how much you pay for coverage. For example, a Corvette is more expensive and likely to be involved in an accident than an Equinox. Therefore, you should assign your teen to the car they’ll drive most often, as this will reflect their actual exposure to risk.

However, this may not be possible if you have enough cars for all drivers in your household. In that case, your insurance company will assign each driver to a specific car, and you may not have much choice in the matter.

Let’s say you have two cars and two drivers, and your teen will be an occasional driver of either your car or your spouse’s car. But if you have three cars and three drivers, your teen will be the primary driver of one of them.

If you have an SUV, a minivan, and an old pickup truck you use for occasional runs to Hafner’s in North Syracuse, your insurance company will likely assign your teen to the pickup truck, even if they rarely drive it.

You may feel frustrated by this, and that’s understandable, but your carrier requires that each driver have a designated car if possible.

3. Should I Get a Separate Policy For My Teenager?

Some parents may wonder if they should get a separate policy for their teenager instead of adding them to their existing policy. This may seem like a good way to avoid paying higher rates for your teen driver, but it’s usually not the best option.

Getting a separate policy for your teenager has several drawbacks, such as:

- It’s more complicated. You have to make sure that the insurance matches the registration of the car that your teen drives. If your teen doesn’t own their own car, you may have to transfer the title of one of your cars to them or buy them a new car.

- It’s more expensive. Teen drivers pay much higher rates than older drivers because they’re considered high-risk by insurance companies.

- It’s more limited. Few insurers will offer policies to newly licensed drivers, and those that do may limit the amount of liability coverage they provide. This means your teen may not have enough protection in case they cause a serious accident and face a lawsuit.

The only “benefit” of getting a separate policy for your teenager is that it may protect your own rates and record from being affected by your teen’s driving mistakes. But for many households, this benefit (if you can call it that) doesn’t outweigh the drawbacks listed above.

Therefore, it’s usually better to add your teenager to your existing policy and take advantage of discounts that some insurers offer for good grades, driver education, or safe driving.

4. Should I Change My Coverage in Any Way?

When you have a new driver in your household, you should review your current coverage and see if you need to make any changes. One of the most important coverages to consider is liability coverage, which pays for the injuries and damages your teen may cause to others in an accident.

When you have a new driver in your household, you should review your current coverage and see if you need to make any changes. One of the most important coverages to consider is liability coverage, which pays for the injuries and damages your teen may cause to others in an accident.

Liability coverage is required by law in New York State, but the minimum limit may not be enough to protect your assets and income from a lawsuit.

Teen drivers are more likely to cause serious and costly accidents than experienced drivers, so you should increase your liability coverage to at least $250,000 per person and $500,000 per accident for bodily injury, and $100,000 for property damage.

This will provide more peace of mind and financial security in case your teen makes a mistake on the road.

Another coverage that you may want to change is comprehensive and collision coverage, which pays for the repairs or replacement of your teen’s car if it’s damaged by an accident, theft, vandalism, fire, or other causes.

Comprehensive and collision coverage is optional unless you have a loan or lease on the car. The cost of this coverage depends on the value and risk level of the car your teen drives. If your teen drives a new, expensive, or high-performance car, keep this coverage to protect your investment.

However, if your teen drives an old, cheap, or low-risk car, you may want to drop this coverage or raise your deductible to save money on your premiums. To learn more about comp and collision, read our comprehensive article on the subject.

You may also want to add some optional coverages that can provide extra benefits for your teen driver, such as:

- Roadside assistance, which covers the cost of towing, battery jump-starts, flat tire changes, and other services if your teen’s car breaks down on the road.

- Rental car reimbursement, which pays for the cost of renting a car while your teen’s car is being repaired after a covered claim.

- Accident forgiveness, which prevents your rates from going up after your teen’s first at-fault accident.

- Vanishing or diminishing deductible, which reduces your deductible by a certain amount for every year that your teen drives without a claim.

- An umbrella policy, which provides an extra layer of liability protection above your auto and home insurance limits if your teen causes an accident that exceeds your regular coverage.

Changing your coverage when you have a teen driver can help you balance the cost and protection of your car insurance policy. You should also review your policy annually and update it as needed.

5. Should I Consider Shopping Around For a New Carrier?

Adding a teen driver to your policy can increase your rates significantly, so it’s a good idea to shop around and compare quotes from different carriers. You should start by getting a quote from your current insurer with the same coverage that you have now so you have a baseline to compare other offers.

Then, you should look for insurers that have lower rates or more discounts for teen drivers. Some insurers may be more willing to insure teen drivers than others, depending on their risk appetite and market strategy.

For example, in New York, Erie Insurance and NYCM tend to have more favorable rates for teen drivers than Travelers, based on our experience in the past few years. However, this may change over time, so you should always check the latest quotes before making a decision.

6. Does My Insurance Cover My Teen with a Learner’s Permit?

Many parents worry about what will happen if their teen with a learner’s permit causes an accident while driving their car. The good news is that your car insurance policy will cover the damages and injuries your teen may be liable for.

As long as you’re in the car with them and supervising their driving.

7. What Could Happen if I Don’t Add My Teen Driver To My Insurance?

You may think that you can save money by not telling your insurance company about your teen driver, but this is a risky move. If your teen gets into an accident and your insurer finds out you have a licensed driver in your household they didn’t know about, you could face serious consequences, such as:

- Your claim could be denied, leaving you to pay for the damages and injuries out of pocket.

- Your policy could be canceled or non-renewed, meaning you would lose coverage and have to find a new insurer.

- You could be charged for premium avoidance, which means that you would have to pay back the difference between what you paid and what you should have paid since your teen got their license.

- Your teen could miss out on building their insurance history, which is important for getting lower rates in the future. Insurance companies look at whether you have prior insurance when they offer you a quote. If you don’t have insurance, you’ll pay more. Being listed as a driver on a policy counts as having prior insurance, so it’s better to add your teen to your policy as soon as possible.

Therefore, you should add them to your policy as soon as the carrier requires you to and look for ways to lower your rates, such as discounts, safe driving programs, or higher deductibles.

8. How Much Will It Cost to Add My Teen to My Policy?

One of the questions that many parents have when their teen starts driving is how much it will cost to add them to their car insurance policy. The answer depends on various factors, such as the age and gender of your teen, the type and value of the car they drive, the region of New York State you live in, and the discounts you qualify for.

However, you can expect to pay more than you do now, as teen drivers are considered high-risk by insurers and have higher rates than older drivers. The bright side is that the cost decreases as your teen gets older and gains more driving experience.

In short, the exact amount will vary depending on your situation. If you want to learn more about the factors that affect the cost of insuring a teen driver and the ways you can save money, you can read our related article: “How much does it cost to add a teenager to car insurance?”

Get Excellent Coverage for Your Teen Driver and Avoid the Pitfalls

Adding a teen driver to your car insurance policy can be a challenging and expensive process, but it’s also an important and necessary one.

Not heeding the advice in this article can cost you more money, expose you to legal and financial risks, jeopardize your teen’s safety and insurance history, and limit your coverage options.

We certainly don’t want that outcome for you. We want you and your teen driver to benefit from excellent coverage and drive with confidence. That’s why you’re reading this article.

Following the advice we’ve presented will allow you to find the best car insurance for your teen driver and save money on your premiums. You can also ensure that your teen has adequate and appropriate coverage while avoiding potential problems with your insurer.

You’ll be able to help them develop good driving skills and habits, build their insurance history, and lower their future rates.

The responsible parent in you will make sure your teen is properly insured and protected on the road.

We can help you with this important transition for your family. We have the experience and expertise to help you navigate this process smoothly and confidently. We’ve helped hundreds of clients find the best car insurance for their teen drivers, and we know which insurers are more favorable and flexible for this situation.

We’ll answer all of your questions and address all of your concerns about insuring a teen driver.

We’ll also guide you through the steps to get the most suitable policy for your needs and avoid the pitfalls of not handling this change properly.

To begin, simply click the Get a Quote button below, and one of our insurance specialists will reach out to you after you supply a few details.

If you’d rather speak to a live agent, call 315-635-2095. We’re waiting to hear from you.

Daniel is an accomplished content creator. He has been working in publishing for almost two decades. Horan Companies hired Daniel as its content manager in November 2022. The agency entrusted its messaging to him. Since then, Daniel has written insurance articles, service and pillar pages, and more. All in an effort to educate CNY readers. He's helping them understand the world of insurance so they can make informed decisions.

Topics:

.png?width=207&height=55&name=Horan_Logo%20Transparent%20No%20Tagline%20(2).png)